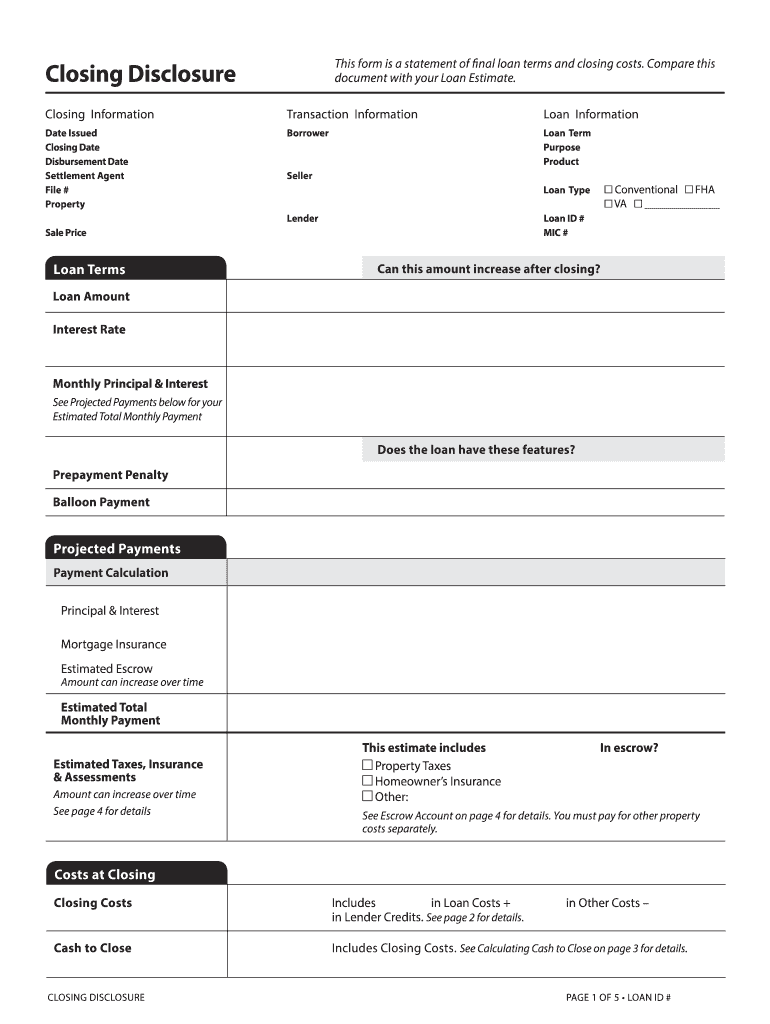

Who needs the Closing Disclosure Form?

The closing Disclosure form is a kind of summarizing agreement defining the final term of mortgage loan and closing costs that is to be concluded by the two parties: the borrower and the lender. Other parties may be involved while signing the Closing Disclosure form including the seller of the property and the real estate broker(s) handling the deal. It is the lenders (the lending institution’s) duty to provide the borrower with the given Closing Disclosure before closing the mortgage loan.

What is the purpose of the Closing Disclosure Form?

Filling out and signing the form is an inevitable step in making a loan agreement. The disclosure reveals all the financial details including calculations of the interest rate and number and amount of monthly payments. These details are important to the parties in case of any misunderstanding in the future.

When is the Closing Disclosure due?

The lender is supposed to deliver the form to the borrower 3 days before the loan closing date. This period is important to the borrower, so the borrow can check all the terms and details of the loan, as they should correspond to those indicated on the previously received Loan Estimate form.

How to fill out the Loan Closing Disclosure?

Other than the information about the parties and the real property being bought, the completion of the form requires indicating a significant amount of financial information:

-

Loan amount;

-

Interest rate;

-

Monthly principal and interest;

-

Payment calculations;

-

Closing costs;

-

Other costs;

-

Summaries of transactions, etc.

Any important additional information covering the transaction details should be put in the Closing Disclosure as well.

Where to send the completed Closing Disclosure?

As already mentioned, the lending institution is obliged to direct the filled out closing Disclosure Form for the borrower’s signature, giving them a 3-day period to double-check the terms of the loan.